Long Live Crypto

The answer to these three questions matters far more than short term market behavior.

Have fundamental technical assumptions of blockchain changed?

Have builders stopped entering the space?

Has the market value decreased over the last decade?

The answer to all three is no. As long as that is the case I will be long crypto.

Don’t let the price swings or the pessimists distract from the core computer science breakthrough that is blockchain. Unstoppable, uncensorable, auditable, verifiable, interoperable, decentralized, global computation engines. This isn’t just internet money. With the release of the Bitcoin whitepaper in 2008, Satoshi Nakamoto solved a longstanding computer science problem by creating a decentralized system that can keep a trustworthy record of transactions. Other attempts to solve this problem before Bitcoin include Digicash and HashCash. My core belief is this new type of computation engine is valuable and has more applications than simply digital money.

We are just scratching the surface on what we can build with crypto. The internet and email were invented in the early 1980s. They did not take off until the 2000s. And two more decades after THAT we are still creating new things on top of this tech stack and will continue to for centuries to come. The design space is infinite. That’s the beauty of bits. And we are early in crypto too.

Right now the experiments are in: Decentralized Autonomous Organizations (DAOs), NFTs (meh), Decentralized Finance (DeFi) with projects like Compound, MakerDAO, and Uniswap, stablecoins like USDC, gaming with the likes of Axie Infinity, layer 2 scaling solutions like Optimism, and social networking with Farcaster. For a good time, visit cryptofees.info to view the millions of dollars a day folks spend to use these applications. The application landscape will likely look very different a decade from now. I use the word “decade” a lot. It’s the only timescale that makes sense when evaluating truly breakthrough tech. History teaches us that.

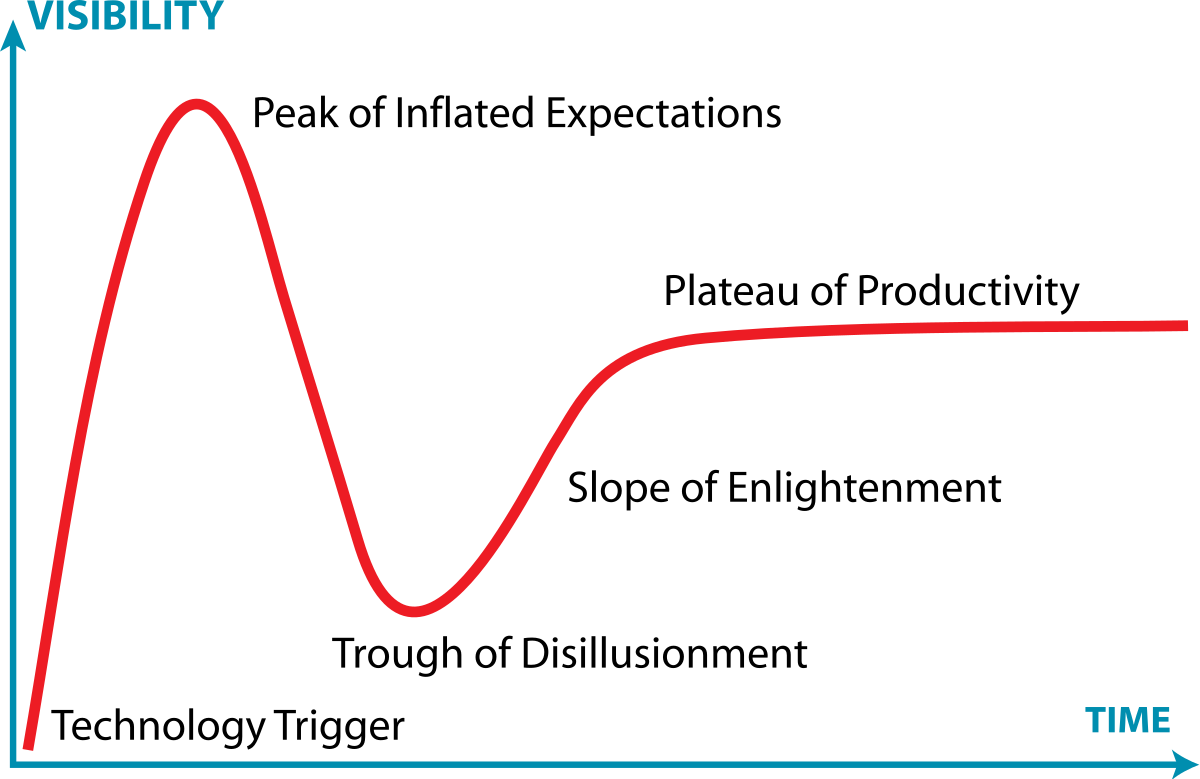

Every technological breakthrough is met with skepticism. The internet had doubters. In an interview with Bill Gates in 1995, when discussing use cases for the internet, David Letterman asks Gates if he has heard of the radio or the tape recorder. Nobel Prize winning economist Paul Krugman said the internet would have no bigger impact than the fax machine. This isn't to pick on Letterman or Krugman, this was the conventional attitude at the time and it was impossible to know how transformative the internet would become. Hell, Gates' own answer to use cases for the internet wasn't exactly the best sales pitch. But that's the point.

Even someone at the forefront of the internet revolution couldn’t have imagined all the amazing things this powerful tech could do. That doesn’t mean all new tech succeeds- most fails. People view technology creation as a long line of inevitability. It’s not. It’s messy. But the reality is ALL breakthrough tech including the telegraph, phone, radio, flight, electricity, elevators, film, tv, and comic books, is met with pessimism, fear, or laughter. It’s also met with hype, too much hype.

That’s why it’s important to take a long term view. When thinking in decades, hype and pessimism fade. And hype isn't even what builds the future, hype wears off. It's the people who put their heads down and build regardless of what the wider world thinks. As I type this, the market has "crashed" while the builders are in the final stages of converting Ethereum's consensus mechanism to Proof of Stake (PoS) - perhaps the most technically challenging undertaking to an open source project of all time - while having to maintain 100% uptime.

But what about all the crypto companies that are failing in this latest downturn? These are projects I either haven’t heard of until now, like Celsius, or projects I was always skeptical of, like TerraUSD or Tether. Pessimists will point to these projects as proof the whole ecosystem is a sham. Bro, I’ve been following this stuff for years. I could have told you to stay away from those projects. I dogged Tether in 2020 just like many others. There are plenty of examples of fraud in the traditional financial system, but most are not naive enough to think the whole system is a fraud - except for communists, folks that only understand the inside of a classroom, or those who put “property is theft” stickers in bathrooms at dive bars.

There is a slow boiling of the toad here that you’ll miss unless you think in decades. A decade ago the conversation was around whether Bitcoin would even survive and/or just go to zero. A decade ago headlines like “Bitcoin price soars above $9” were written. Now Bitcoin falls to $20k and headlines like “Why is the largest cryptocurrency crashing” are written. Where is the sense of perspective? The fact that Bitcoin is even worth $1 and has been for over a decade is incredible. It's astounding that Bitcoin's fundamental blockchain breakthrough is being used not just for internet native money but for building full blown applications with platforms like Ethereum. The question is no longer whether Bitcoin is bullshit, but rather how far humanity will tumble down the crypto rabbit hole.

Looking to build in the crypto space or software in general? We have experience. I cofounded Fullsend, a studio helping innovative companies build best-in-class apps. Let's talk, reach out to me at dick@fullsend.io.